Demystifying The Path To Private Equity

Navigating the Landscape that Comes After the Investment Banking Analyst Program

Step 2

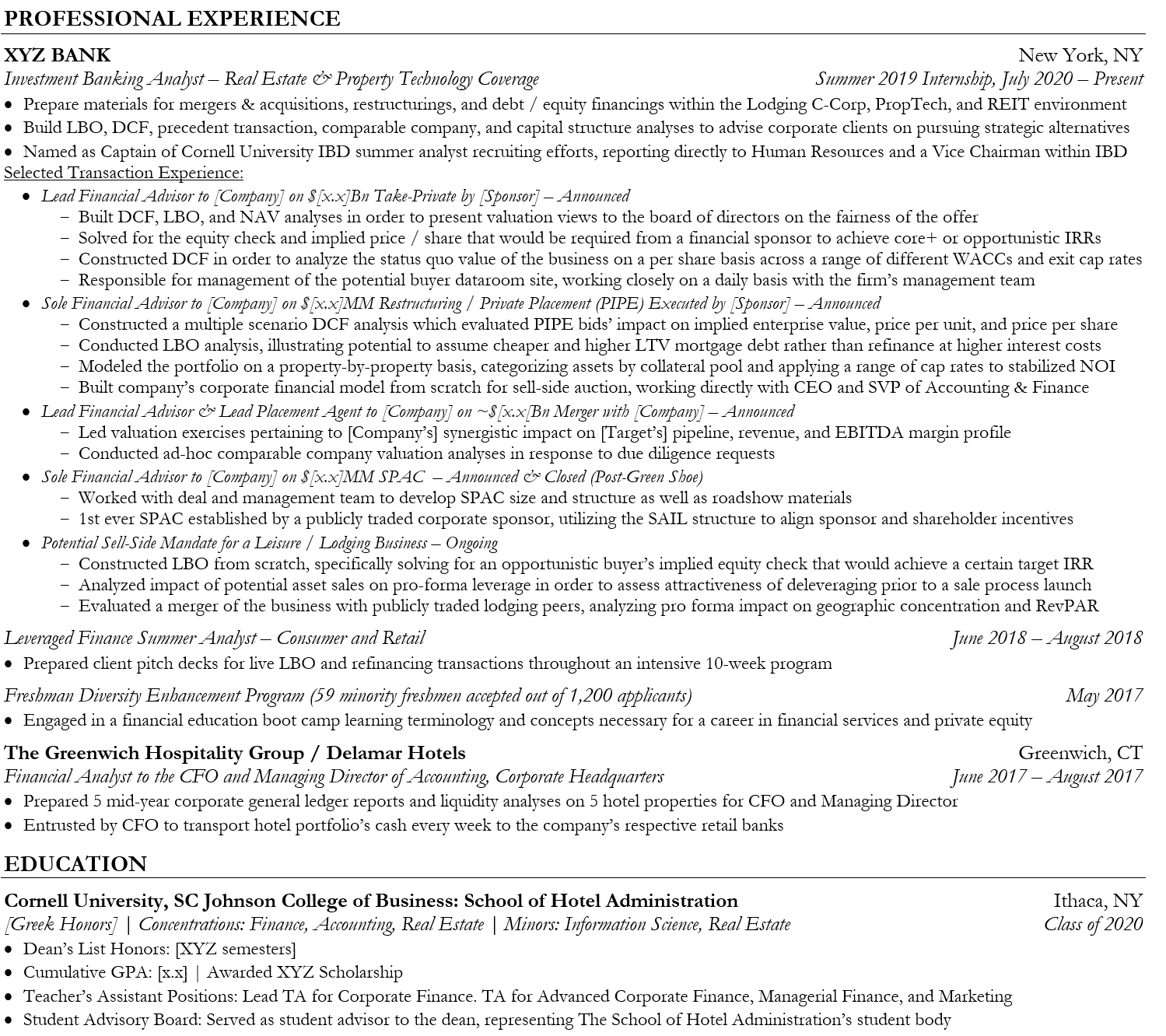

Ensuring your resume is in the proper format is an essential box to check. Use your undergraduate resume as a starting point -- the main formatting changes that will occur to get your resume ready for private equity recruitment include:

Beginning your resume with work / professional experience, followed by education. Think of this section as eventually filling 1/2 - 2/3 of the page -- as I mention below, you will not have a significant, if any, deal experience by the time on-cycle recruiting kicks off. Because of this, I have also uploaded a resume template “Resume Template - Fresh to IB” in the “Downloadable Resources” section, along with the “1 Year of IB” version, the main difference being inclusion / exclusion of deal experience and level of detail pertaining to leadership and extracurriculars (as discussed below)

As shown below, your work / professional experience will be more detailed in nature, going into specifics about deals and projects that you have worked on -- each deal / project should have its own "section", as shown below, to make the deal type and involved companies clear. As highlighted in Step 3, and as expected, you won't have tangible deal experience to add if participating in on-cycle recruiting since as highlighted in Step 1, the process occurs very soon after you begin your investment banking analyst program. Unless you are on one of the fastest quick-to-announce deals in history, every incoming investment banking analyst is in the same boat!

You should feel comfortable using deals or projects from your summer internship as long as you can clearly remember the project details and articulate your responsibilities / work product in a potential interview -- if you are to include details from deals during your summer, start the resume process shortly after the internship so that the information on what you did is fresh in your mind

While it goes without saying, you should be discrete and smart about the level of detail disclosed about any transaction or project on your resume -- if it is a transaction that has not yet announced, be brief about the deal / project scope and err on the side of caution

Your education section will for the most part stay the same -- be sure to:

Include any relevant business, leadership, or community-service extracurricular activities (i.e. see third bullet under “XYZ Bank” and the "Cornell Financial Analysts" example below)

Due to an absence of deal experience by the time on-cycle recruiting begins, detailing your leadership experiences and ways you’ve shown interest in finance and business outside of the classroom is critical to showing the headhunters and respective private equity firms your work ethic and ambition

Ensure to keep interests on your resume -- a large part of the interview process (as highlighted in Step 7) is the firms assessing cultural and team fit as well, so it is important to highlight what is unique to you outside of work!

The below resume example is a version of my own that I used for on-cycle recruiting -- as a full disclaimer, the on-cycle recruiting process was delayed ~1 year for investment banking analysts that entered their full-time roles in 2020 due to COVID-19 -- because of this, I was fortunate to have been a part of a few announced deals by the time the process eventually kicked off. It is completely fine if yours, for the time being, is only 1-2 projects from your summer internship. The full “Resume Template” can be found in the "Downloadable Resources" section. Note, it is edited and redacted in various places to create a template-like feel that I hope is useful to you!

Resume Layout