Demystifying The Path To Private Equity

Navigating the Landscape that Comes After the Investment Banking Analyst Program

Step 4

Technical Preparation - Paper LBO and Model Test

Starting technical preparation early on avoids any unnecessary cramming and allows you to approach the preparatory process with ease. A large part of the interview process will be assessing candidate's technical ability. While tested through normal course technical questions (see "Top 10 Technical Questions" as well as “Brainteaser Questions” in the "Downloadable Resources" section), including a "Paper LBO" (discussed below), the main way a candidate's technical ability will be assessed is through a 60-90 minute modeling test (“90 Minute Modeling Test” uploaded to “Downloadable Resources” section).

To best prepare for the aforementioned 60-90 minute modeling test, I'd recommend completing a dry run 2-3 times a week. While private equity courses like those of Wall Street Oasis and Peak Frameworks are held to a very high regard (I personally used Wall Street Oasis's course), they often come with a significant price tag (~$300). The intent of this website is to enable access for all, so I have created a sample 90-minute modeling test (with a solution key) that can be found in the "Downloadable Resources" section. This test is a full three-statement from scratch LBO, which in my opinion, is the toughest test you could expect. While some firms will give you modeling tests with a pre-built template, knowing how to do this from scratch (i.e. preparing for the most challenging test) will make everything else you encounter, easier. To become comfortable with modeling dry runs, I recommend taking the following approach:

Completing the test 1-2 times at your own pace, without a timer, to get used to the concepts and functionality

Completing the test 2-3 times with a 120 minute timer to start building muscle memory

On the ~4th attempt, try the model using the 90-minute timer

I also want to flag that most of the time, practice modeling tests will be available on your investment banking group's work drive -- just ask the fellow analysts! Because I transitioned to corporate buyout private equity vs. real estate private equity, the tests on my work drive were not as applicable, which is why I made an investment in the Wall Street Oasis course. If you decide to make this investment, I do not endorse Wall Street Oasis vs. Peak Frameworks -- both are great and of equal quality. I chose the Wall Street Oasis route simply because I had friends who had gone through the recruiting process use the course, and they recommended it for me considering I was coming to corporate buyouts from real estate.

Paper LBO:

During a typical 1st round private equity interview, your interviewer may give you several assumptions and ask you to calculate "returns" (i.e. Internal Rate of Return, otherwise known as IRR, and Multiple-On-Invested-Capital, otherwise known as MOIC). This is your standard paper LBO technical question, as you will need to do this using a pen and scratch pad (NO EXCEL). I am including an example that I created below, utilizing questions I have encountered and seen in the past:

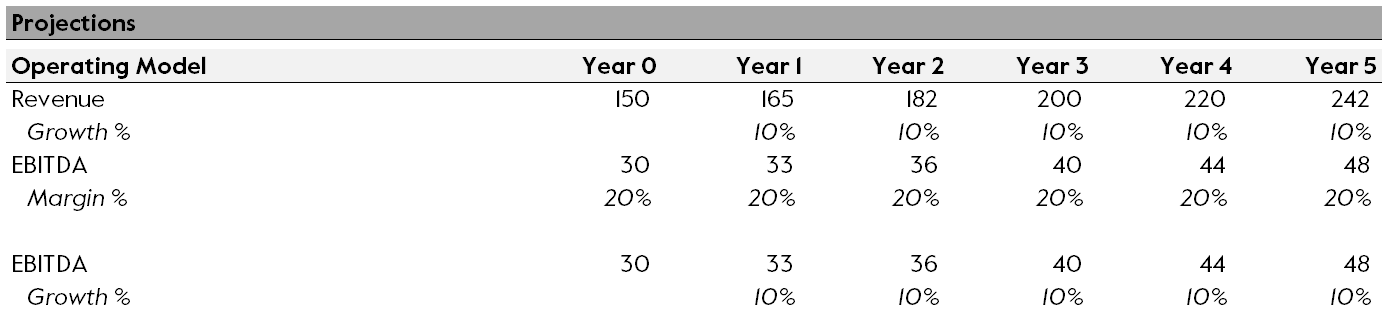

Interviewer: "Assume you buy a company for 12.0x LTM EBITDA at the end of Year 0. Assume you are able to finance the transaction with 6.0x leverage off of LTM EBITDA, and the debt has an interest rate of 10.0%. This business does $150m of revenue and $30m of EBITDA in Year 0. The company grows at 10.0% every year, and EBITDA margin remains flat throughout the investment time horizon. Assume that D&A and CapEx are 6.0% of Year 0 revenue throughout the investment hold. Change in net working capital requirements is 1.0% of revenue each year, and the tax rate is 20.0%. If you exit at the end of Year 5 assuming exit multiple is the same as that of entry, what are returns?

Steps:

While you should assume that debt used in the LBO is paid off at the end of the hold period (i.e. no voluntary debt repayment nor mandatory amortization), confirm this with the interviewer. Note, that they might omit information (i.e. interest rate on debt, whether or not margins expand, or net working capital information) intentionally to see if you know the required components to calculate returns -- if you notice anything missing, be sure to ask the interviewer. They are just trying to see how you think. After all, that is the point of this exercise!

You want to walk the interviewer through your thought process -- do not do the whole thing and then walk them through it!

Start off with explaining to the interviewer how you would calculate Sources & Uses, the 1st walkthrough step. $30m of LTM EBITDA at 12.0x LTM EBITDA equates to a purchase price of $360m. Since you are financing at 6.0x LTM EBITDA, this is $180m of debt, so the sponsor would have to use $180m of equity financing. Start off with Uses -- your Uses will be a Purchase Total Enterprise Value of $360m, while your Sources are $180m of debt and $180m of equity

Next, walk the interviewer through how you would calculate levered free cash flow ("LFCF"). Do not bridge to LFCF from EBITDA, but instead, bridge from net income, as this is what the interviewer typically expects / it also reduces your chance of calculating incorrectly (i.e. accidentally calculating taxes off of the wrong anchor). The below serve as efficiency tricks that can be applied to the full projection model shown below:

Because you confirmed with the interviewer at the beginning that there was to be no voluntary debt paydown nor mandatory amortization, your interest expense will be the same every year

Instead of calculating taxes, and then subtracting from EBT to get to Net Income, just take EBT * (1-Tax Rate) -- doing so cuts the number of calculations in half, utilizing another efficiency trick

Since D&A and CapEx are the same % of revenue per the directions, they cancel each other out when building to free cash flow. Hence, you can utilize another efficiency trick and skip calculating them altogether

Notice that the directions say "net working capital requirements". Requirements are usually synonymous with cash outflows, hence the negative change, per the below, but be sure to confirm with the interviewer, as a vague "change in net working capital is $5m every year", for example, could very well mean an inflow or an outflow

Next, move on to your operating model build. As a general rule of thumb, when margin stays flat, EBITDA will grow at the same rate as revenue. Because this is the case, you can indicate to your interviewer that you could simply grow the EBITDA at 10.0% each year and not have to calculate revenue (see comparison below). Since you are dealing with mental math, the goal is to minimize any room for error -- hence, using this trick can help reduce the chance of that happening (i.e. calculating 5 numbers instead of 10). This might be an area of efficiency that your interviewer could be on the lookout for anyways -- since you'll be dealing with decimals here, be sure to confirm with your interviewer if utilizing whole numbers is ok. This test is all about efficiency / thought process, not to-the-decimal accuracy. Be sure to articulate the annual EBITDA to the interviewer so they can follow your math

The below illustrates the Paper LBO in its entirety (the “Paper LBO Backup” is also saved in the "Downloadable Resources" section). Please remember that you will not be able to use excel for this question, as it is all mental math-based -- the excel in the “Downloadable Resources” section only serves as an answer key, and should be practiced using actual pen and paper. A rule of thumb, it is worth memorizing the IRR and MOICs for a five-year hold (i.e. 2.0x MOIC equates to 15% IRR, 2.5x MOIC equates to 20% IRR, 3.0x MOIC equates to 25% IRR, and a 3.5x MOIC equates to a 28% IRR). The returns here are 2.4x MOIC and 20% IRR (see “Returns” section below) -- the interviewer might ask you if this is a deal worth pursuing. Typically, the industry return threshold for whether or not a potential opportunity is "worth it" is a 20% IRR -- since this opportunity just meets the threshold, it might be worth highlighting something like the following: "As modeled, the opportunity just meets the threshold for what an Investment Committee might consider acceptable at a 20% IRR -- we have not modeled any margin accretion, which would bring incremental upside to returns. Understanding how real this upside would be, I believe, is key in making this deal work given the current baseline return profile. I would be in favor to conduct more diligence to fully understand the operational efficiency opportunity. Should it not be as realistic (i.e. it is currently private-equity owned, and for this reason has already been subject to cost-takeout), and if there are other competing opportunities with better return profiles, I would also see reason to pass"

Developing an Investor Mindset: The above verbal answer on whether or not this Paper LBO situation would be a good potential investment to pursue is a part of developing an “investor mindset”. I’d recommend starting to practice “thinking like an investor”, whether this is reading equity research and analyzing the subject company in the light of whether it would be a good LBO candidate or long / short investment, internalizing news articles and press releases with the follow-up question “how can I make money off of this news?”, or identifying public companies of interest and tracking them to see what macro / market news impacts earnings and the stock price.